Crude Attempting to Breakout

Crude Rally Pauses

Crude prices are a little softer today with momentum stalling for now on the back of yesterday’s push higher. The futures market hit its highest level since October earlier in the session before sell interest took hold. A sharp downturn in USD is helping drive commodities prices higher midweek. Rising geopolitical uncertainties have been a key theme of this Dollar decline and look set to keep USD skewed lower for now, allowing crude room to push higher.

US/Iran Fears

Growing fears over a potential US strike on Iran are seen in response to news that the US has move key military assets into the Middle East. While no fresh rhetoric has been heard from Trump, traders are fearful of such a move give the unpredictable nature of his policy decisions recently. If a strike was launched this would see oil prices sharply higher given the potential for big supply disruption.

Winter Storms in US

Huge winter storms in the US have also contributed to crude upside this week with around 2 million barrels per day of output lost over the last week. With extreme weather conditions continuing in places the impact looks set to remain for now with inventories likely to see sharp declines in coming weeks which should further support prices.

Technical Views

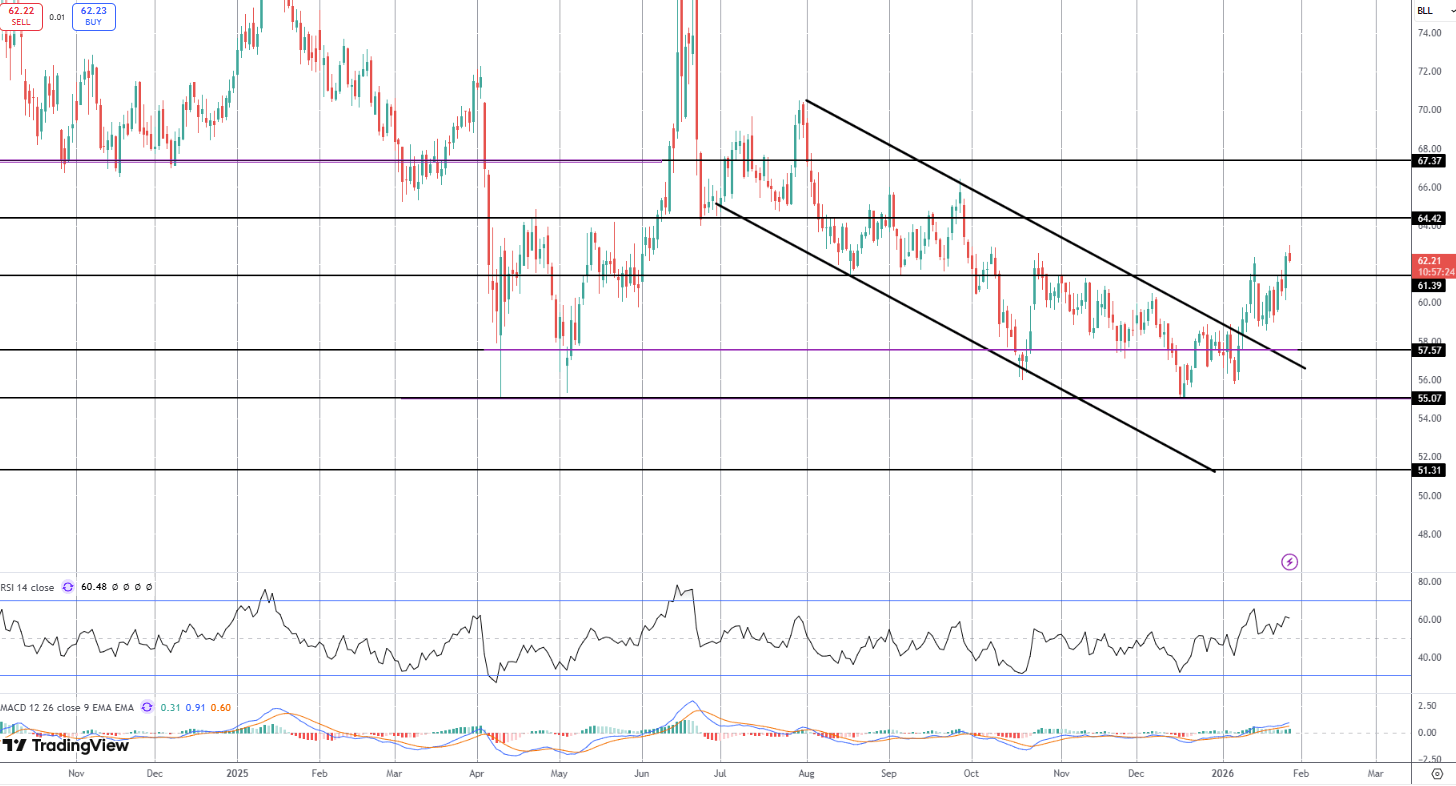

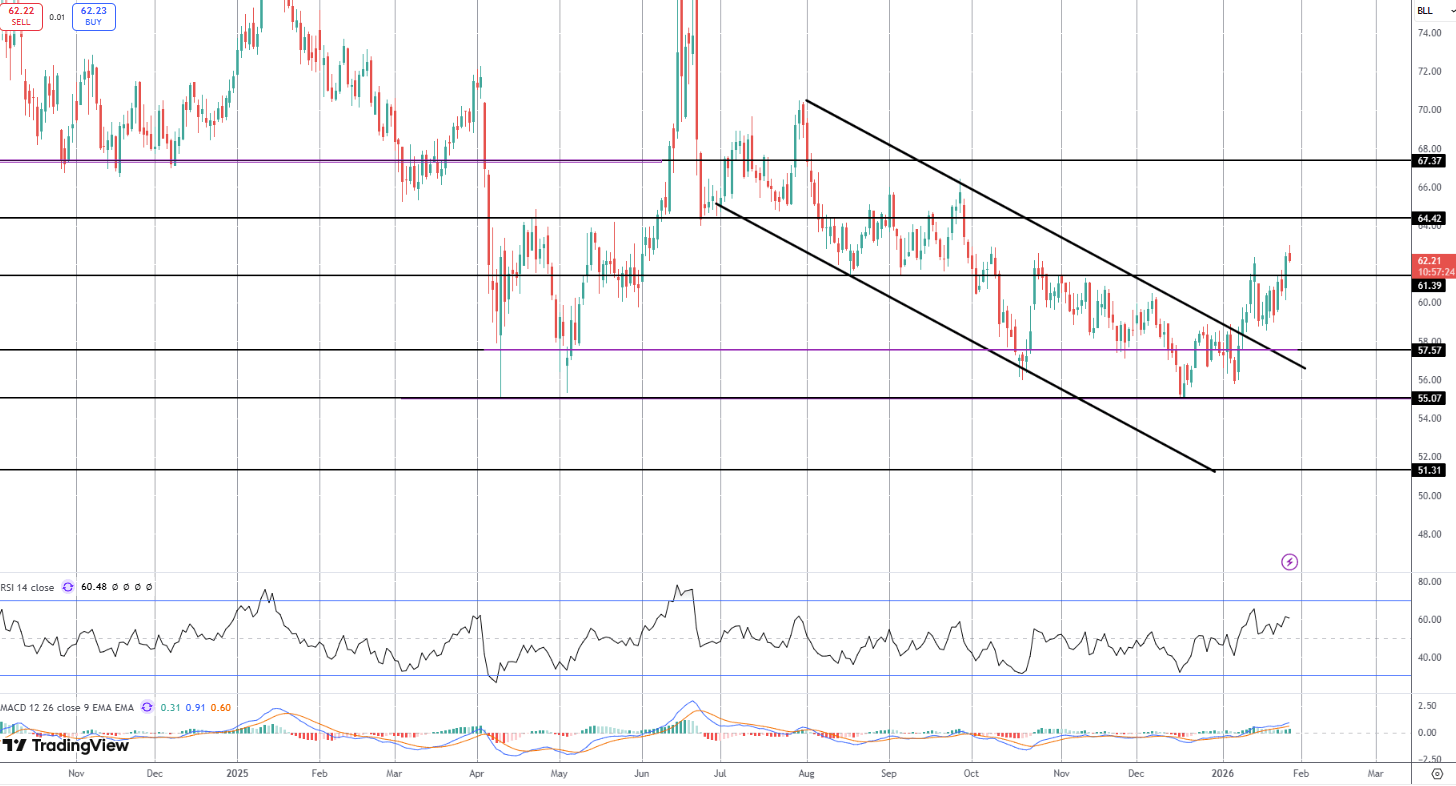

Crude

The rally in crude has seen the market breaking back above the 61.39 level. While the move has stalled for now into a test of early Jan highs, the outlook remains bullish while above the 61.39 level with 64.42 the next bull target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.