FTSE 100 FINISH LINE 16/12/25

On Tuesday, London's FTSE 100 experienced a drop, impacted by declines in energy and defence sectors, as investors contemplated new employment data that bolstered the likelihood of an interest rate cut by the Bank of England later this week. The FTSE 100, which is comprised of the UK's leading companies, dipped 0.7%, having previously closed 1% higher, while the midcap FTSE 250 index remained mostly steady. Energy stocks decreased by 1.1%, following a decrease in oil prices due to strengthening prospects for a Russia-Ukraine peace agreement, which raised hopes for a potential relaxation of sanctions. Britain's unemployment rate climbed to its highest level since early 2021, while private sector wage growth slowed to its weakest pace in nearly five years ahead of Finance Minister Rachel Reeves' annual budget last month. This discouraging jobs report intensified expectations that the Bank of England might cut interest rates on Thursday to support the faltering economy.

The Aerospace and Defence index fell by 1.8% amid discussions regarding a possible peace deal in Ukraine. Major defence companies in Britain, including Rolls-Royce, BAE Systems, and Babcock, saw their shares decline between 1.4% and 4.1%. U.S. officials stated on Monday that Ukraine might receive security assurances based on NATO's Article 5 mutual defence agreement under the suggested peace terms with Russia. Conversely, precious metals and mining stocks rose by 1.4%, while travel-related indices gained 0.9%, with at least 17 sectors experiencing positive trading. In individual stock movements, IG Group shares surged by 5.6% after the online trading platform announced expectations of reaching revenue growth around the midpoint of its projected range for 2026. Similarly, Serica Energy's stock increased by 2.71% following news of its agreement to acquire a portfolio of assets in the Southern North Sea from Spirit Energy.

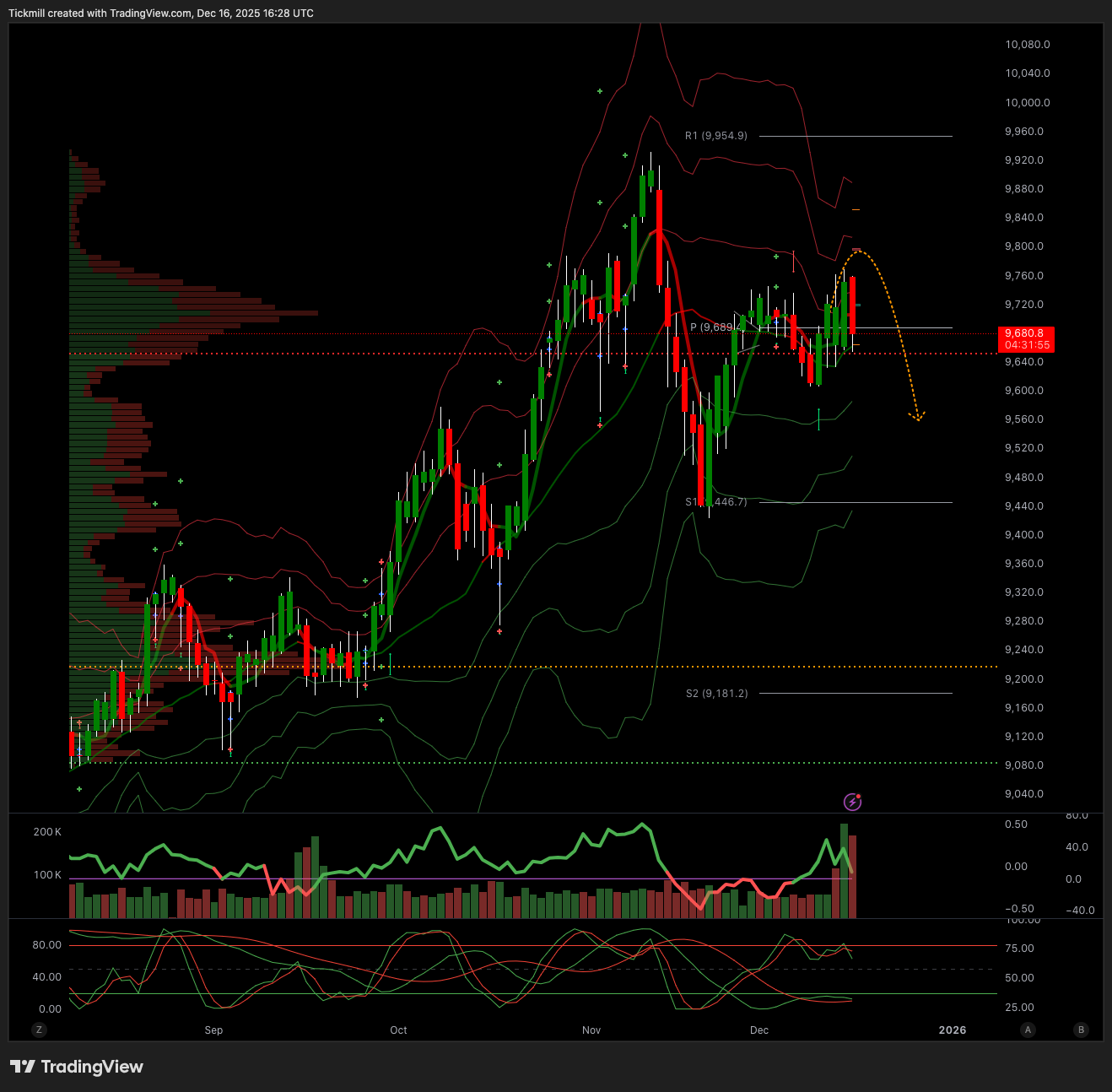

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bearish

Weekly VWAP Bearish

Above 9720 Target 9800

Below 9700 Target 9550

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!