Institutional Insights: Standard Chartered 'Lowering BTC Forecast'

Standard Chartered Global Research report dated December 9, 2025.

## 🧭 Summary

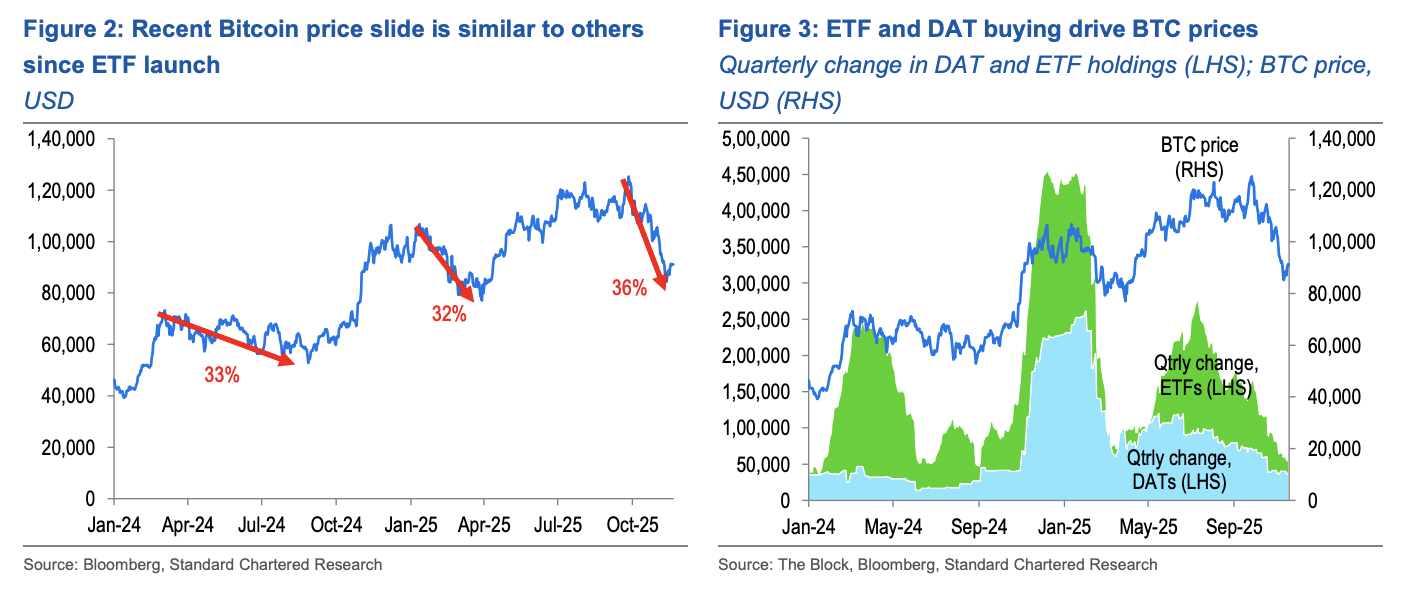

Standard Chartered has significantly lowered its near-term Bitcoin price forecasts while maintaining its long-term bullish target. The bank argues that the "crypto winter" narrative is incorrect; instead, the market is experiencing a consolidation phase.

The core thesis is that one of the two main engines of price growth—**Corporate Treasury buying (DATs)**—has stalled, leaving ETF inflows as the sole driver of future price appreciation. Consequently, the timeline to reach $500,000 has been pushed back from 2028 to 2030.

---

## 📉 Key Drivers for the Downgrade

### 1. The End of "DAT" Buying (Corporate Treasuries)

The report suggests that corporate buying of Bitcoin (by "Digital Asset Treasuries" or DATs like MicroStrategy) is likely over.

* The Mechanism: Previously, companies traded at a high premium (mNAV > 1.0), allowing them to issue equity at a premium to buy Bitcoin, effectively "turning $1 into $1.50."

* The Shift: Valuations have dropped. MicroStrategy’s mNAV has fallen below 1.0 for the first time since 2023. Without this premium, the financial engineering loop no longer works.

* Outcome: Expect consolidation of holdings rather than selling, but no new buying pressure from this sector.

### 2. Reliance on ETFs "One Leg Only"

With corporate buying gone, Bitcoin is now effectively driven by one leg only: ETF buying.

* Slower Pace: While ETF inflows are expected to continue, they will likely be slower and more periodic than the "dual-engine" buying seen previously.

* Gold Parallel: The report compares this to Gold ETFs, which took ~7 years to reach structural equilibrium.

### 3. The "Halving Cycle" is Dead

Standard Chartered explicitly rejects the "4-year halving cycle" theory.

* They argue that price peaks occurring 18 months after a halving is no longer a valid predictor.

Price action is now dominated by *demand flows (ETFs)** rather than supply shocks.

---

## 📊 Revised Price Forecasts

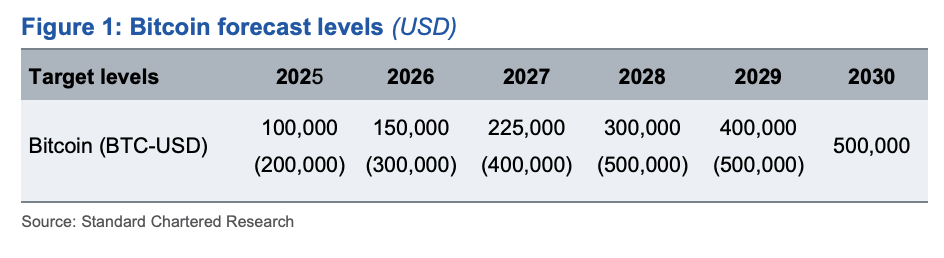

The bank has slashed year-end targets for the next four years, pushing the long-term peak out by two years.

| Timeframe | Old Forecast (USD) | New Forecast (USD) | Change |

| :--- | :--- | :--- | :--- |

| End-2025 | $200,000 | $100,000 | 📉 -50% |

| End-2026 | $300,000 | $150,000 | 📉 -50% |

| End-2027 | $400,000 | $225,000 | 📉 -44% |

| End-2028 | $500,000 | $300,000 | 📉 -40% |

| End-2030 | N/A | $500,000 | 🎯 Target |

---

## 💡 Macro & Long-Term Support

Despite the near-term downgrade, the report outlines several bullish factors that make the $500,000 target attainable by 2030:

* Political Pressure on the Fed: The likely appointment of Kevin Hassett to the FOMC and pressure from President Trump could lead to rate cuts even with high inflation. This increases the appeal of Bitcoin as a hedge against US Treasury risks.

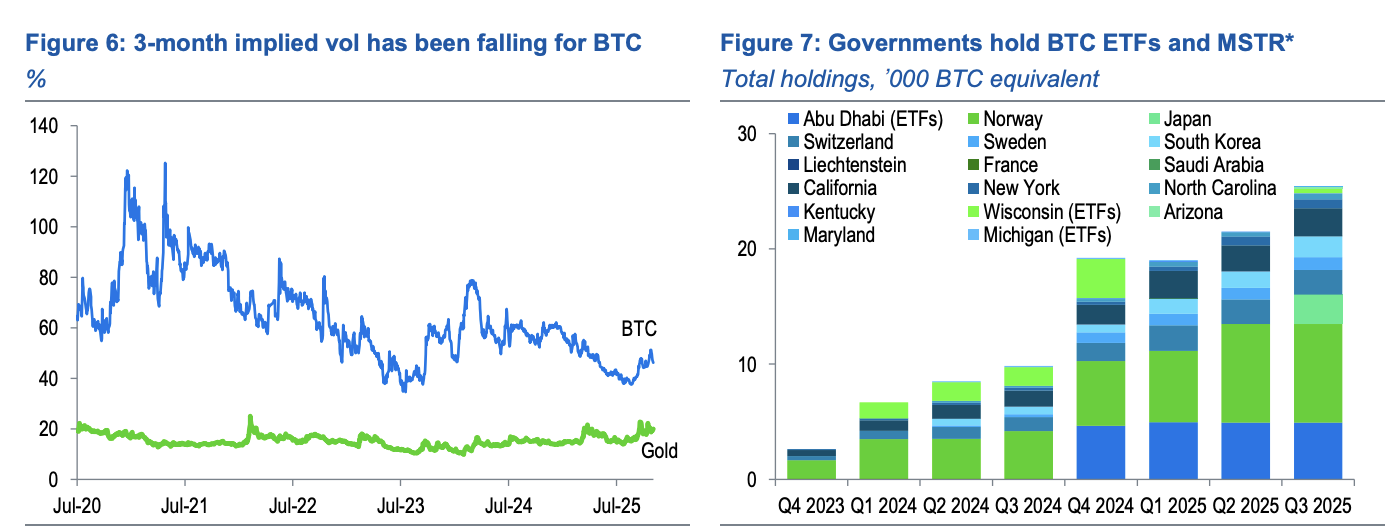

* Portfolio Optimization:

* Global portfolios are still massively underweight Bitcoin relative to Gold.

An "optimal" portfolio (based on volatility) would hold between *12% and 36% Bitcoin** (vs. Gold). Current market caps imply a mix of only 5% Bitcoin.

Closing this gap represents a *2.5x to 7x upside** from current prices.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!