Institutional insights: Goldman Sachs SP500 Positioning Update

December–January, in our view, wouldn’t lead to immediate refunds or tariff removals. However, it did spark some incremental relief trades and a brief rally in cyclicals.

Key feedback from the past 24 hours includes:

1. Local election results are significant—they could help reduce political gridlock and bring us closer to ending the government shutdown.

2. Restoring political stability may help ease repo and rates volatility, which has been gradually increasing.

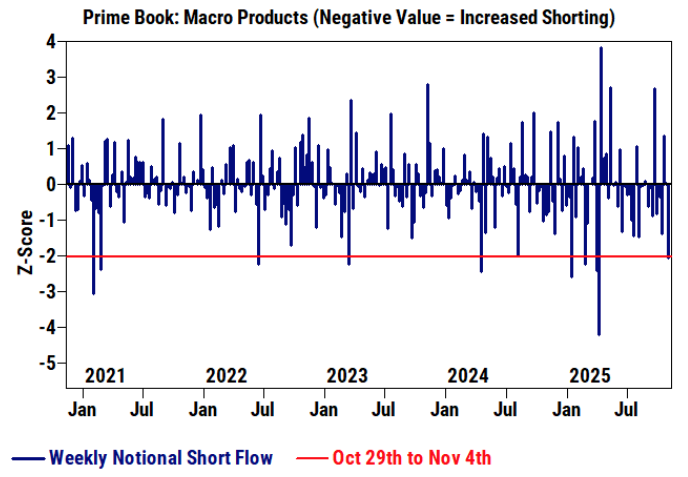

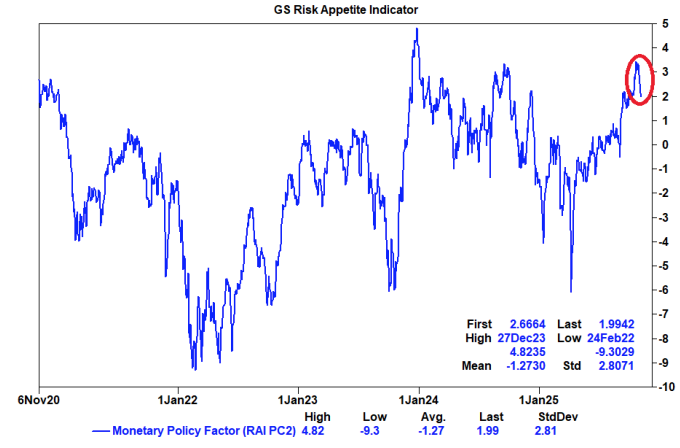

Despite recent market volatility, we’ve observed no clear signs of de-grossing. Risk-on flows remain robust, with strong single-stock demand. However, there has been a noticeable rise in hedging activity, particularly in macro products such as ETFs, futures, baskets, and volatility instruments. Shorting activity over the past week has reached one of the most extreme levels (excluding April) seen in several years.

That said, core positions have largely remained steady. In our view, this reflects short-term caution rather than a fundamental shift in sentiment. Investors, myself included, are feeling slightly more uneasy, even though the underlying fundamentals remain largely unchanged.

In our view the street remains long S&P gamma, especially on the downside, which we think creates a near-term buffer and should provide some market support on local selloffs as we’ve seen.

Yesterday, late in the day, headlines from OpenAI triggered a selloff in NVDA and a broader market decline as investors evaluated the potential implications of AI infrastructure financing. Concerns arose over whether the government might act as a backstop or if private credit funding would become necessary, raising fears of a higher cost of capital for the AI capex cycle.

AI positioning remains robust but increasingly selective. The narrative has shifted from a “buy-everything” approach to a zero-sum game, with market movements highlighting clear winners and losers. Against this backdrop, Jensen Huang’s comment in the Financial Times that “China is going to win the AI race” was particularly striking. He pointed to advantages such as lower energy costs, looser regulations, and aggressive state subsidies for data centers, which position China favorably compared to the US. China’s readiness to reduce power costs and fast-track chip development accelerates its AI expansion rather than hindering it. While this may partly serve as a strategic move to bolster NVDA’s global chip sales, the statement carries weight.

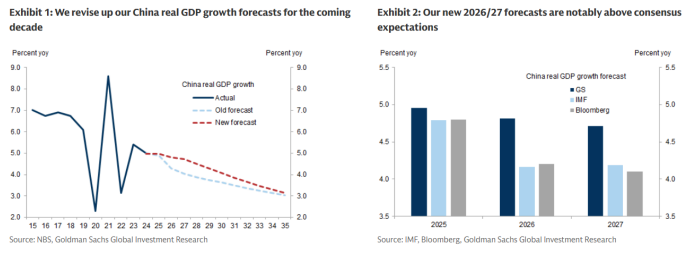

Meanwhile, we have revised our 2025 China GDP growth forecast upward to 5.0% (from 4.9%), with growth projections of 4.7–4.8% through 2027. This optimism is underpinned by stronger exports, easing pressures from the property sector, and renewed fiscal and monetary support. The broader macroeconomic sentiment in China has shifted positively, with the 4th Plenum and the upcoming Trump–Xi summit emphasising manufacturing competitiveness and AI-driven industrial upgrades.

This sets the stage for one of the more compelling opportunities in the market: China AI plays. This sector stands out as a direct beneficiary of enhanced policy support, lower energy costs, and increased domestic AI investment. The desk is also exploring strategies to capitalise on this theme, including directional views or hedges positioning China AI as outperforming US AI.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!